Colored diamonds have gained popularity not only in the world of jewelry but also in the investment sector. Their combination of beauty, rarity, and increasing demand makes them an attractive option for those looking to diversify their portfolio with high-value tangible assets.

But are colored diamonds really a profitable investment? In this article, we will analyze their market behavior, the factors that influence their value, and how to make a smart decision when investing in them.

If you’re interested in learning more about the diamond investment market, we recommend reading:

➡️ How to Invest in Diamonds

1. What Are Colored Diamonds and Why Are They So Valuable?

Colored diamonds, also known as “fancy diamonds”, are natural gems that exhibit a wide range of colors, such as yellow, pink, blue, green, and red. Their coloration is due to the presence of certain chemical elements or deformations in their crystalline structure.

Some factors that make colored diamonds so coveted include:

✔ Rarity: They are much less common than colorless diamonds. Some colors, such as red and deep blue, are extremely scarce.

✔ Growing Demand: Highly valued by collectors and investors.

✔ Increasing Value: Their price has shown an upward trend in recent years.

If you want to learn more about the impact of color on a diamond’s value, we recommend this article:

➡️ The Impact of Color on Diamond Value

2. The Most Valuable Colored Diamonds in the Market

2.1. Blue Diamonds

Blue diamonds get their hue from the presence of boron in their structure. They are extremely rare and often fetch astronomical prices at auctions.

Famous example: Hope Diamond, one of the most legendary gems in the world.

🔎 Learn more about them here: Blue Diamonds: Origin, Value, and Unique Characteristics

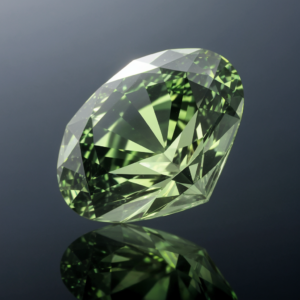

2.2. Green Diamonds

Green diamonds are unique because their color comes from natural radiation exposure during their formation on Earth.

Famous example: Dresden Green Diamond, one of the most iconic stones.

🔎 Discover their value and characteristics here: Green Diamonds: Origin, Value, and Characteristics

2.3. Red Diamonds

Red diamonds are the rarest of all. Their color is due to a plastic deformation in the crystalline structure, and their availability is extremely limited.

Famous example: Moussaieff Red Diamond, a 5.11-carat diamond valued at millions of dollars.

🔎 Learn more about them here: Red Diamond: What It Is and Its Meaning

3. Are Colored Diamonds a Profitable Investment?

3.1. Increase in Value Over Time

Colored diamonds have shown a steady increase in price over the past decades. Some reasons include:

✔ Decreasing Supply: Most mines producing colored diamonds, such as the Argyle mine (the primary source of pink and red diamonds), have closed or are nearing depletion.

✔ High Demand at Auctions: At auction houses like Sotheby’s and Christie’s, colored diamonds reach record-breaking prices.

3.2. Liquidity and Resale Market

Unlike other investments, diamonds do not have a stock exchange where they can be sold quickly. Reselling may take time and depends on finding the right buyer. However, the rarest colored diamonds retain their value and even appreciate over time.

3.3. Certification and Authenticity

To ensure a successful investment, it is crucial to acquire diamonds certified by recognized laboratories such as:

✅ GIA (Gemological Institute of America)

✅ IGI (International Gemological Institute)

✅ HRD (Hoge Raad voor Diamant)

4. Factors to Consider Before Investing in Colored Diamonds

If you’re considering investing in colored diamonds, keep the following aspects in mind:

4.1. Color and Rarity

✔ The more intense and pure the color, the higher its value.

✔ Diamonds with rare hues, such as red and deep blue, have greater appreciation potential.

4.2. Carat Weight

✔ Diamonds over 1 carat are generally more attractive to investors.

✔ The higher the carat weight, the greater the value per unit.

4.3. Shape and Cut

✔ A good cut enhances the diamond’s color and brilliance.

✔ Popular cuts for investment include the radiant cut and the cushion cut</